Critical challenges ahead for bank and non-bank lenders in the UK and Europe

Date 23 March 2020

Type Insights

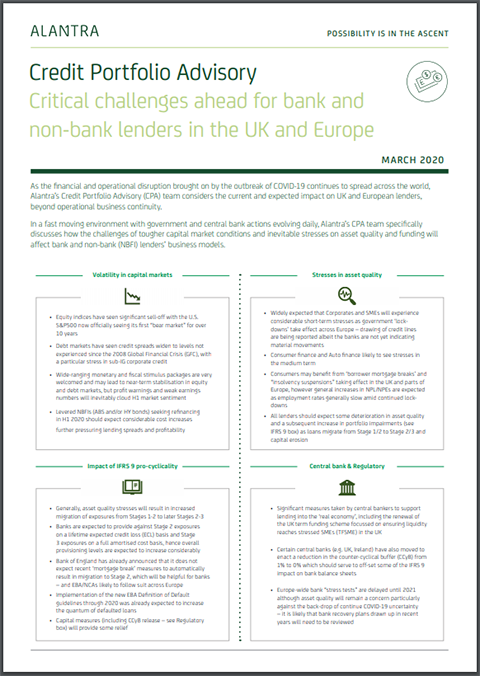

The spread of Covid-19 is having a profound effect on Alantra’s banking and non-bank lender client base. Already we’re observing a number of market, central bank and regulator developments that are impacting bank and non-bank lender liquidity, capital and asset quality, whilst at the same time requiring them to navigate new accounting / regulatory rules and measurements. Accordingly, Alantra’s Credit Portfolio Advisory (CPA) team has prepared a short discussion paper outlining how Covid-19 is impacting those clients.

In unprecedented times, Alantra’s CPA team represents the largest and only independent, global financial advisor to banks and non-bank lenders. We have:

- Excellent access to capital, including to those investors that are continuing to step forward and provide debt and equity in the current market;

- Over 150 professionals across 3 continents, including 35 Pricing & Analytics team members capable of providing clients with credit (portfolio) valuations, data set analysis, cash flow analysis, business plan builds and ABS structuring;

- Boots on the ground in key markets, who are operating “business as usual” and are able to quickly address strategic issues alongside our clients; and

- A resilient business that is capable of quickly solving challenging questions for clients.

We are reaching out to our bank and non-bank lender clients this week (via telephone and video conference of course) to walk through our analysis and to provide you with an opportunity to discuss our views, current market developments and how we can help. If you’d like to speak with our team, please reply directly to Andrew Jenke, Nick Colman, Joel Grau or any of our senior team mentioned in our paper.

Warm regards,