The investment banking market has demonstrated a great momentum through the last two years. In an operating environment in which uncertainty abounds, global M&A volumes topped $5tn for the first time, according to Refinitiv, up 64% from 2020.

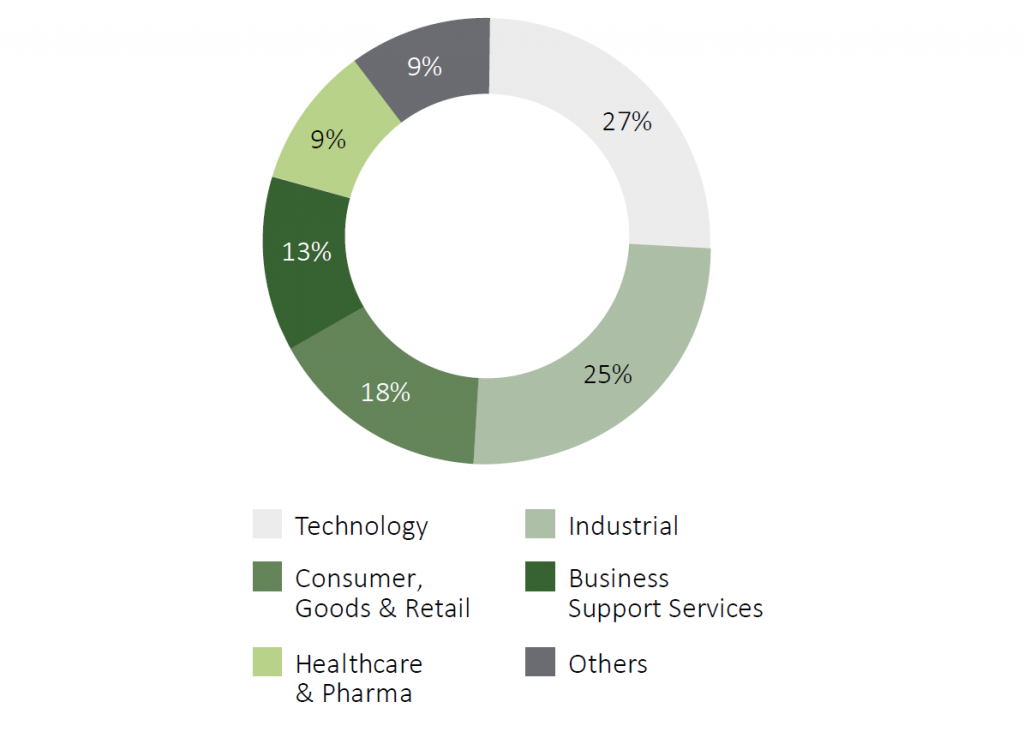

The acceleration of technology adoption, as well as other innovative capabilities motivated by the pandemic, has resulted in strategic acquisitions from companies seeking a distinctive competitive advantage. This context reaffirms the need for independent advisory services aligned with the interests of clients and investors that deliver the right solutions across economic cycles.

In answer to the multiple variables shaped by the post-pandemic scenario, Alantra specialises in advising on unique and complex transactions.

Some of the noteworthy transactions we successfully closed this year included advising ARYZTA on the sale of its North American and Latam operations to Lindsay Goldberg and Grupo Bimbo, advising Foster + Partners on its strategic partnership with Hennick & Company, advising Equistone and the management team on the sale of Oikos to Goldman Sachs, advising Aspyr Media on its sale to Embracer Group for up to $450m, advising Provalliance’s shareholders on the sale of a majority stake to Core Equity Holdings, and advising the shareholders of global beauty business Pangaea on its investment from Inflexion.

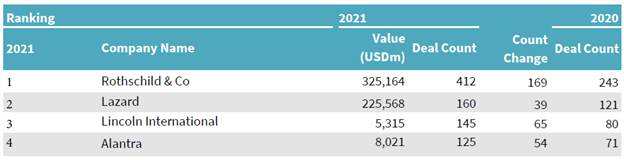

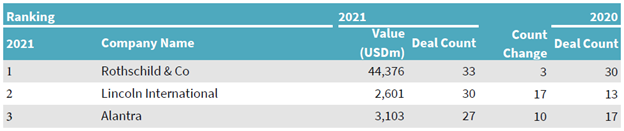

These transactions exemplify the Investment Banking team’s ability to advise intricate and global deals, offering flexible, independent, and professional solutions. Our approach enabled us to reach one of the top positions in Mergermarket’s latest league tables, ranking as the #3 independent advisor to Private Equity Houses in Europe, and the #4 to Independent Advisor in Europe by the number of deals advised.