Growth at scale across the technology sector

Date 4 August 2021

Type Alternative Asset Management

“Article 3/4 on disruptive tech trends. See the previous note on Cybersecurity”

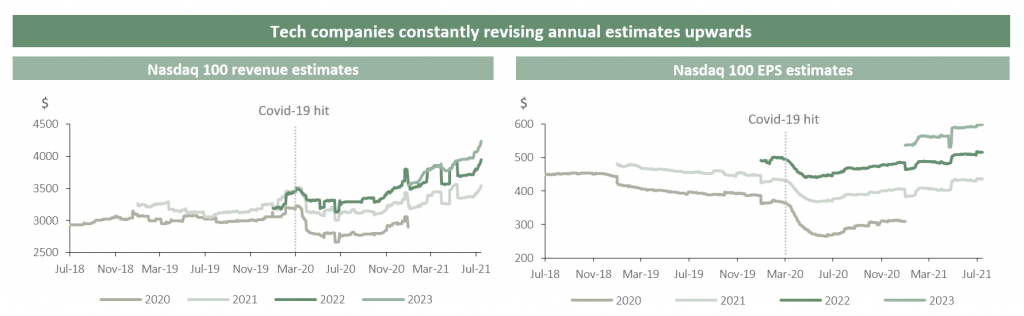

One interesting perspective is that within the tech-heavy Nasdaq 100, we have seen robust revenue estimates and continuous upward revisions. A glance below shows major revisions in expectations around March 2020; however, for 2021 and beyond, estimates are now materially higher than pre-pandemic levels. For example, we have seen sales estimates being revised c.15% and c.25% upwards in 2021E and 2022E, respectively. The constant revision we are witnessing is supported by the accelerated adoption of software, e-commerce, cloud and other tech fields.

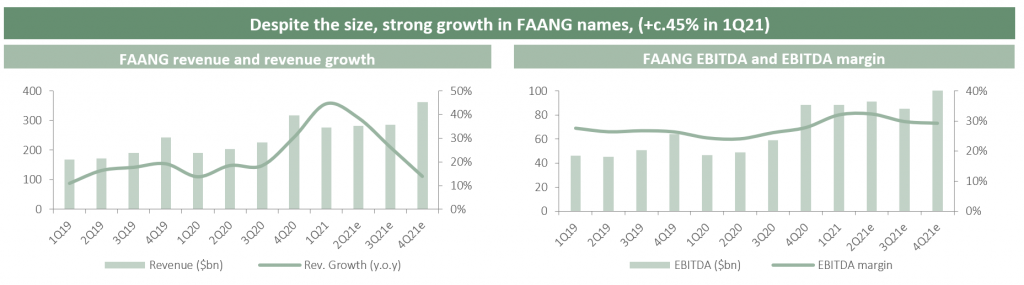

FAANGs growing at scale. FAANG names have proved the depth and size of addressable technology markets. Despite being some of the largest companies in the world, revenues of FAANG companies are expected to grow by 50% in the next two years, demonstrating massive scalability at revenue levels not seen in the past (trillion-dollar companies expanding c.45% in 1Q21). This growth, coupled with increasing profitability, is evidence of the pricing power of established grown-up tech businesses. However, with all of these companies at close to record high valuations and representing c.21% of the S&P 500, and building concerns regarding regulation, we have seen muted share price reactions to recent results. Despite such businesses have tended to be non-core for AGTF, we do see them driving a large part of spending and investment across the ecosystem in TMT.

Source: Bloomberg consensus estimates. (1) Total FAANG financial metrics calculated as the sum of their total revenue and EBITDA.

In our view, all of this is a reminder of the continuing tech disruption that is yet to come. As evident in many of our companies, the addressable markets of many tech businesses are at the early stages of adoption. One perspective that we ascribe to is that when such rapid growth at scale is possible, it is understandable why we are tempted to argue that the ‘next F.A.A.N.G’ may be undervalued (we suggest that several components of the AGTF portfolio belong to this group, with sizeable addressable markets and increasing competitive moats).

Alantra Global Technology Fund Team

*This article is an extract from the fund’s 2021 outlook letter. If you would like to be added to the fund’s distribution list contact [email protected]

This is article contains information (the “Information”) of Alantra Global Technology Fund (hereinafter, the “Fund”), a subfund of Canepa Funds ICAV, and it has been prepared by Alantra EQMC Asset Management, SGIIC, S.A. (hereinafter, “Alantra AM”). Alantra AM has not obtained an independent verification regarding the accuracy and integrity of the information used, nor a confirmation of the reasonability of the hypothesis considered. The Information has implicit subjective judgements. In particular, most of the criteria are based in estimates of the Fund’s future results. Considering the inherent uncertainties regarding any information concerning the future, some of these hypotheses may not materialize as defined.

The Information is not an offer to buy, sell or subscribe for securities or financial instruments and is not intended to be investment advice. Any decision to buy or sell securities issued by the Fund subject to this Presentation should be based on the legal documentation of the relevant Fund, in particular the subscription agreement and the prospectus of the Fund and the Key Investor Information Document (KIID) as it is filed with the applicable regulatory authorities from time to time, or on publicly available information on the related companies. The recipients of the Information must bear in mind that the securities or instruments discussed in herein may not be suitable for their investment objectives or financial circumstances, and past performance should not be taken as a guarantee of future performance. The Fund is an UCITS fund under the 2009/65/EC Directive.

In light of the above, neither Alantra AM, its officers, directors or employees, or its shareholders, may be held in any way liable for damages that could arise, directly or indirectly, as a result of decisions taken on the basis of this Information or any use given it by its recipients.