Alantra generated revenues of €111.9 million (-25.7%) and net profit of €15.1 million (-51.0%) in the first nine months of 2020

Date 28 October 2020

Type Financial Results

Net revenues reached €111.9m (-25.7% YoY), having generated €31.3m in Q3 amidst a challenging market environment. Net revenues from the Investment Banking division reached €75.3m (-14.1% YoY), despite a -19.3% [1] drop in global deal making activity YoY.

Net revenues from the Credit Portfolio Advisory division were €16.0m (-31.2%), despite the 39.2% YoY drop in the European non-performing loan market, its lowest level in the last five years [2].

In Asset Management, revenues decreased by 49.6% to €19,5m, due to lower performance fees (€1.4m YTD, which compares with €17.8m in the first nine months of 2019), and a change in the consolidation perimeter [3]. Net revenues from management fees remained stable at €18.1 Mn (+0.1% YoY).

Operating expenses amounted to €92.7m (-25.1% YoY). Fixed personnel expenses slightly increased to €51.0m (+7.3% YoY) due to the incorporation of new teams; whereas variable retribution fell by 47% YoY, to €20.5m, due to a lower performance from the business; and other operating expenses decreased to €16.7m (-35.3% YoY).

As a result, net profit attributable to the parent reached €15.1m (-51.0% YoY), of which €14.2m correspond to the fee business, €1.3m to the portfolio and -€0.5m to other results.

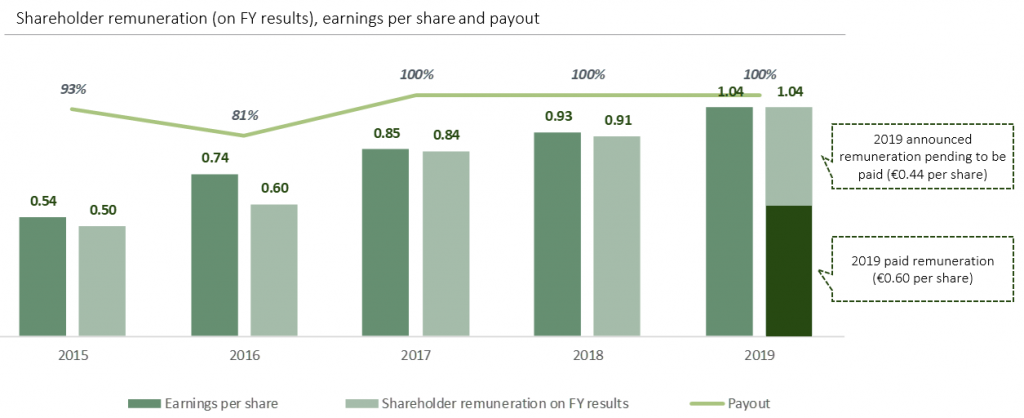

The Annual Shareholders’ Meeting has approved the payment of a €0.44 per share dividend, which will be paid in November 2020. Factoring in the €0.60 per share interim dividend already paid out in December 2019 on account of 2019 consolidated net profit, shareholder remuneration will total €1.04 per share, amounting to a 100% payout and a dividend yield [4] of 9.9%.

Alantra maintains its strong financial position, with €248.5m of shareholders’ equity attributable to the parent, €160.4m in cash, cash equivalents and cash invested in a monetary fund, €36.6m portfolio of investments in products managed by the group, and no financial leverage.

Additional steps towards growing Alantra’s asset management business in Europe through the acquisition of a strategic stake in Indigo Capital reported in October, a leading independent European private debt manager with assets under management of more than €400m.

Alantra incorporated 35 senior professionals as part of the firm’s efforts to further strengthen its diverse and specialist service offering, including the appointment of César Ciriza (Managing Partner, Head of Infrastructure), Mario Schlup (MD, Technology Switzerland), and André Pereira (MD, Head of ECM Spain) in Investment Banking. The Credit Portfolio Advisory division added a new head in Portugal, Manuel de Macedo Santos.

The Investment Banking division advised on 80 transactions YTD, including: CR Hansen’s $530m acquisition of UAS Labs; Six’s €2.8bn takeover for Spain’s Stock Exchange operator BME; Migros’ sale of its Swiss luxury department store chain Globus to Signa and Central Group; Elkem’s acquisition of China Polysil Chemicals; Embracer Group’s €525m acquisition of Saber Interactive; and Bain Capital’s sale of T.M. Lewin to SCP Private Equity.

Alantra ranked as the #3 independent advisor in Europe by number of deals advised, and #4 advisor globally for transactions involving private equity players [5].

Alantra’s Credit Portfolio Advisory division has advised on 16 transactions in 2020 worth over €16bn. Notable transactions include advising Eurobank on the largest Greek NPL securitisation to date (Project Cairo), with a total value of €7.5bn; and advising Piraeus Bank on the signing of its first NPE securitisation (Project Phoenix), with a total value of €1.9bn.

[1] Source: Dealogic Investment Banking Scorecard – Global M&A volumes Q1-Q3.

[2] Source: Debtwire European NPLs 3Q20

[3] Alantra WM is consolidated under the equity method since June 2019, following the sale of a 50.01% stake of Alantra WM to Grupo Mutua.

[4] The dividend yield has been calculated considering the total 2019 shareholder remuneration (€1.04) and the average share price of the last month as of October 19th, 2020 (€10.53).

[5] Mergermarket’s Global and regional M&A activity during Q1-Q3 2020, including financial advisor league tables. The ranking only includes independent advisory firms. Full rankings available here: https://www.mergermarket.com/trendreports/reports/01589f2f-78f2-4faf-b24a-0be9ecc62776