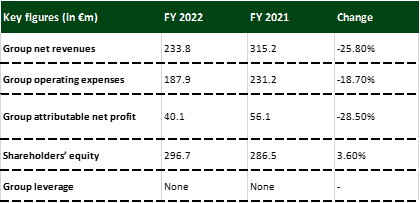

Alantra delivers geographically diverse net revenues of €233.8m (-25.8%) and a net profit of €40.1m (-28.5%) in 2022

Date 23 February 2023

Type Financial Results

Results

- Alantra’s FY 2022 net revenues were down 25.8% compared to the Group’s record year 2021 and came in at €233.8m. In line with the decline in global M&A activity (-39%)[1], Alantra’s Investment Banking revenues decreased to €145.1m (-29.7% YoY). Credit Portfolio Advisory revenues, in turn, increased to €54.2m (+5.4% YoY).

- In Alternative Asset Management, revenues from management fees were up 11.6% YoY at €32.9m in a particularly challenging fundraising environment. The business unit’s net revenues, however, decreased to €33.7m (-39.2% YoY) caused by the absence of performance fees (-€25.1m YoY) amid challenging market conditions.

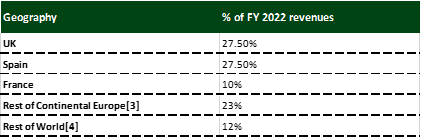

- Alantra recorded geographically highly diversified revenues, with 65% of total revenues having been generated in the Group’s three key hubs, the UK, Spain, and France. The rest of Continental Europe accounted for 23% and the rest of the world for 12% of total revenues.

- Operating expenses decreased to €187.9m (-18.7% YoY) driven by the strong drop in performance-related variable retribution (-59.6%).

- Net profit attributable to the parent company stood at €40.1m (-28.5% YoY), of which €32.9m correspond to the fee business, €0.2m to the portfolio and €7.1m to other results, mostly derived from the sale of the remaining stake in Alantra Wealth Management, completed in Q2 2022.

Balance sheet

- As of 31 December 2022, the Group maintains a strong balance sheet, with €296.7m of shareholders’ equity attributable to the parent and no leverage.

- As of 31 December 2022, the Group had €98.7m in cash, cash equivalents and a monetary fund, following the deduction of the upcoming variable retribution pay-out of €45.6m and the dividend that the Board of Directors intends to propose at the Annual General Meeting (AGM) of €19.3m (see below). Alantra also held €62.4m across a portfolio of investments in products managed by the Group.

Shareholder remuneration and investment in the Group’s growth

- The Board of Directors will propose the distribution of a dividend of €19.3m (€0.50 per share) at the Annual General Meeting to be paid in May, equal to c. 60% of FY 2022 ordinary net profit and in line with last year’s pay-out percentage. The retained profits will increase the Group’s cash resources to continue investing in growth opportunities.

Business Activity

- In Asset Management, Alantra launched two new strategies (Solar Energy and Cybersecurity) in 2022 and increased capital commitments for its Private Equity, Energy Transition, Life Sciences and Real Estate Debt funds.

- In 2022, Investment Banking completed 137 transactions (-26% YoY) worth €8.5 bn across different industries: 30% in Technology, 22% in Industrials, and 17% in Consumer Goods and Retail[2]. The Group strengthened its specialized capabilities with 10 new senior professionals in Technology, FIG, and Healthcare.

- The Credit Portfolio Advisory business advised on 59 transactions in 2022 worth €25.2bn, including some of the largest NPE securitizations in Europe.

- Alantra launched two transversal groups to respond to two of the most pressing challenges for the global economy, Technology and Energy Transition, supporting companies in maximizing their value by accelerating growth or gaining efficiencies through the digitalization or decarbonization of their operations.

[1] Source: Dealogic M&A Highlights: FY22

[2] According to Mergermarket 2022 FY League Tables and deal count, Alantra ranked seventh among independent advisors in Europe and has been shortlisted for European Corporate Finance House of the Year in the 22nd edition of the Real Deals Private Equity Awards.

[3] Italy, Germany, Greece, The Netherlands, Portugal, Belgium, Austria, Luxembourg, Ireland, Sweden, Denmark, and Switzerland

[4] US, China, UAE