Macro Update – March 2025

Macro Update – March 2025

Global markets are experiencing volatility due to Trump’s tariff policies, which are negatively impacting both his popularity and the U.S. economy. At the same time, there are encouraging developments elsewhere: European policymakers are moving toward relaxed fiscal rules and business-friendly regulations; China is responding with measured tariffs and ambitious fiscal policies; Japan maintains positive momentum; and other Asian economies continue to show strong growth and stability.

Given the mixed conditions, the recommended investment strategy balances offensive equity positions (with significant underweighting of U.S. markets until Trump’s policies shift) alongside defensive positions emphasizing duration and yen versus the dollar as hedges against continued policy missteps.

U.S.

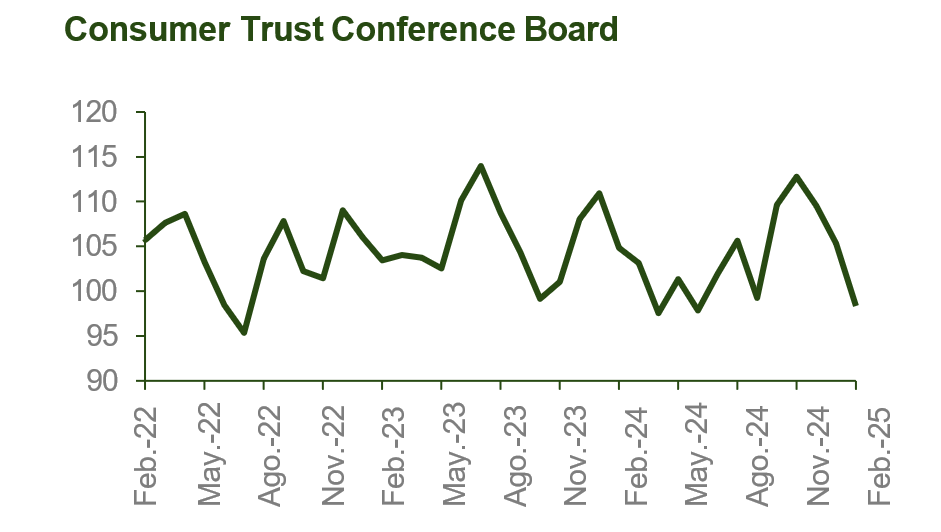

Trump’s tariff policies are creating significant economic challenges for the U.S., as evidenced by deteriorating activity indicators and rising inflation expectations, which may limit the Federal Reserve’s flexibility going forward. If the president continues his tariff escalation, these negative trends will likely worsen, making it essential to closely monitor his statements and actions in the coming weeks to assess potential further impacts on the economy and markets.

Eurozone

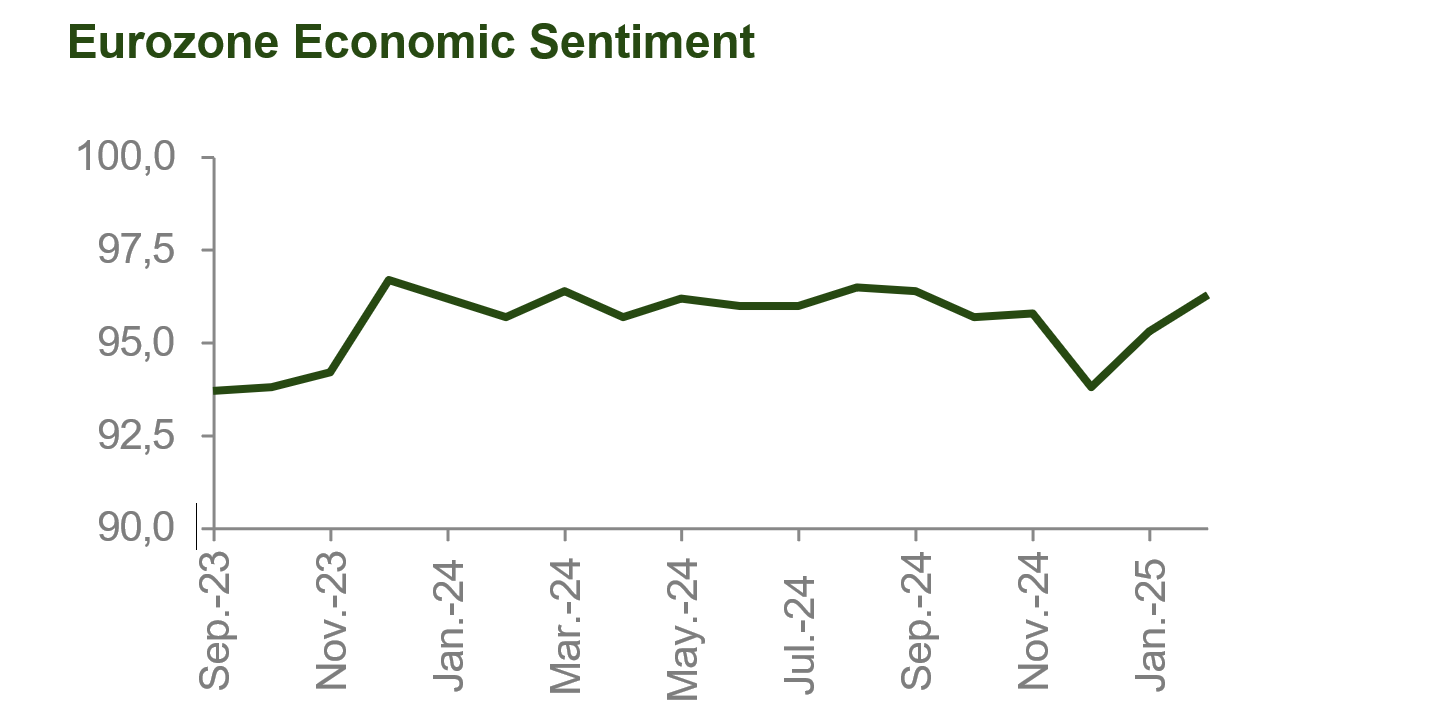

The Eurozone shows promising signs despite tariff concerns, with improving activity data and a strong European response to Trump’s aggressive stance. The European Commission is proposing increased military spending through exceptional fiscal rule clauses, while Germany’s new government has relaxed its “debt brake” and approved a significant defense and infrastructure fund. EU policymakers are strategically shifting toward regulatory simplification and reduced administrative burdens for businesses.

Additionally, moderating service inflation and wages are creating room for the ECB to implement necessary interest rate cuts throughout the year, potentially below neutral levels if fiscal expansion proves insufficient to counteract the negative effects of Trump’s tariffs on European growth.

China

China shows macroeconomic improvement, including early signs of housing market recovery, while authorities strategically avoid retaliatory tariffs in favor of ambitious fiscal stimulus measures aimed at boosting domestic demand.

Japan

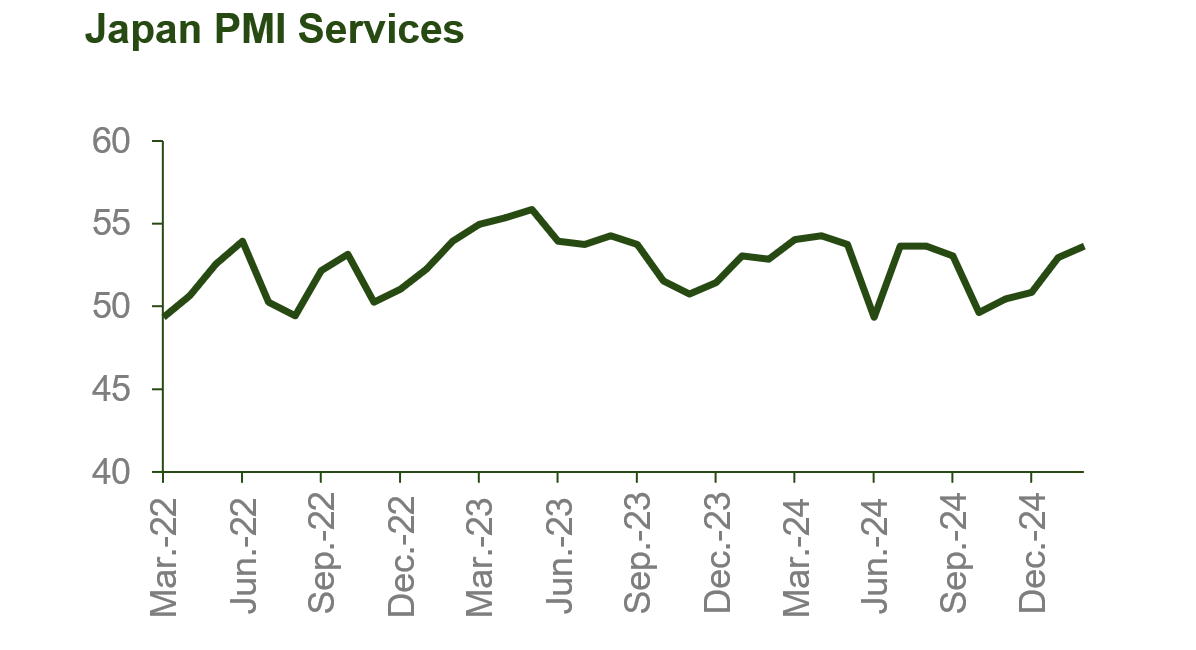

Japan continues its positive trajectory with solid economic activity, core inflation stabilizing around 2%, and encouraging wage growth forecasts for 2025, which should support private consumption and help sustainably achieve the Bank of Japan’s inflation target over time.

Equities: A moderately constructive position in equities is maintained with strong geographic diversification, overweighting Europe versus the US due to negative impacts of Trump’s tariffs on US macroeconomics, signs of improvement in Europe, and the fact that US equities are not particularly cheap.

Government Bonds: Given current yield curves and despite recent disappointments, it’s a good time to use duration as a hedge against potential negative demand surprises, focusing on government curves with solid public finances where inflation risks are reasonably balanced.

Corporate Credit: Given low credit spread levels and already offensive positions in equities, the preference is to concentrate on high-quality credit issues with relatively short terms.

Currencies: In response to tariff noise, the Japanese yen is favored against the dollar due to its safe-haven status and Japan’s good economic outlook, while also seeing attractiveness in currencies like AUD, NZD, GBP, NOK, and SEK that offer attractive carry levels in economies with reasonably favorable macro scenarios.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.