Key outtakes from yesterday’s ECB meeting

The ECB seems eager to cut rates in June – should wage moderation continue.

Also, Lagarde clearly indicated the European monetary authority’s readiness to lower rates several times during the remainder of the year.

Some of the elements that led us to make the above statements are as follows:

- The ECB downgraded inflation forecasts: the 2% headline inflation target would be reached next year while underlying inflation would converge to the central bank’s target within the 2-year period. By forecasting lower inflation, this signals a willingness to lower rates.

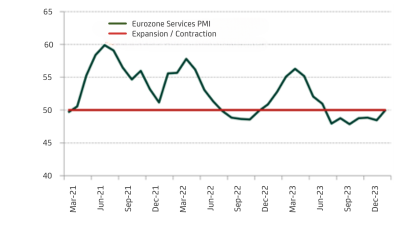

- Lagarde pointed out that growth risks are on the downside. While this view could be challenged, from a monetary policy point of view, if the central bank believes that activity risks are on the downside, that again implies a greater willingness to lower rates.

- Lagarde was pleased that core inflation is moderating and that the first encouraging signs are also appearing in wages – in addition, Lagarde also considers it positive that corporate margins are absorbing part of the wage increase because this denotes less excess demand and helps the disinflation process.

- Lagarde explicitly stated that it is very likely that they will have the confirmation of wage moderation, and they need to start lowering rates by June.

- Lagarde said she does not want to discuss the number of cuts but is comfortable with a market discount of around 4 cuts this year.

The bottom line is that falling inflation, economic activity showing some signs of improvement, and a dovish central bank create a perfect mix of risk assets. Looking a bit further ahead, and in a context where financial conditions are not tight at all, we do not rule out at all that economic activity will surprise on the upside and that the moderation of inflation will end up being somewhat slower than currently discounted. Should this be confirmed, we believe that the ECB will end up lowering rates less than currently assumed. In any case, this is not necessarily bad news for risky assets: after all, economic growth will be healthy, and, of course, it is very difficult to see rate hikes.