Macro Update – July 2024

Macro Update – July 2024

Until the market starts worrying about high deficit and public debt levels in certain countries, the global economy’s performance in the coming months looks optimistic. In the absence of shocks, global growth should align with potential; underlying inflation should moderate due to well-anchored price expectations; and central banks will probably have a path to lowering interest rates, though only moderately, as neutral rates are higher than before the pandemic.

In the US, growth rates are expected around 2%, with core inflation gradually declining. The Fed may start cutting rates in September, potentially down to around 4% over the next year. In the Eurozone, despite political issues in France, moderate economic recovery is anticipated, with growth rates exceeding 1% in 2024, core inflation decreasing (though more slowly than in the US), and the ECB possibly lowering rates once more this year, with a terminal rate of around 3% in 2025.

Risks include public debt and deficit concerns, complicated political situations in major economies, and potential protectionist tensions following the US elections in November. These factors could disrupt economic stability and growth, making it essential to monitor political developments and trade policies closely.

Several factors suggest a significant moderation in US economic activity compared to the second half of 2023: the depletion of pandemic savings, a clearly less expansionary fiscal policy, potential slowdown in corporate investment due to electoral uncertainties, and relatively high long-term real interest rates.

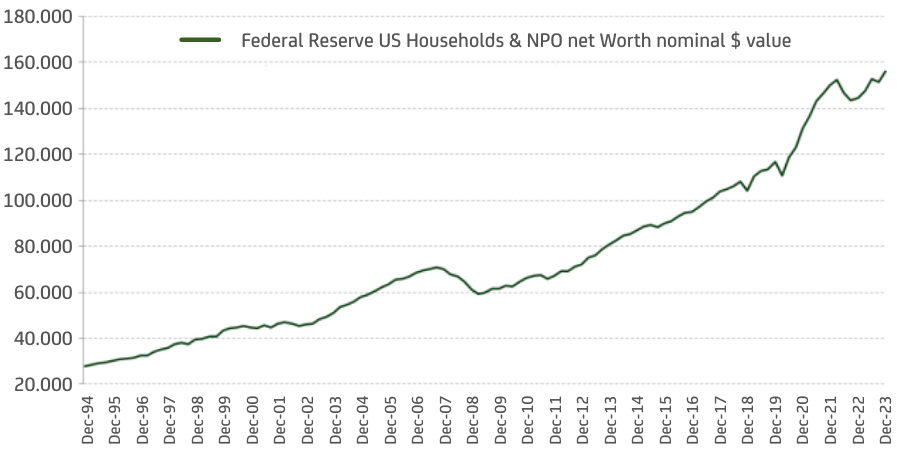

However, the strong fundamentals in the US economy keep recession risks low. American consumers see wages rising faster than inflation, feel secure in their jobs due to low unemployment, and have favorable net wealth. Fiscal policy remains neutral this year, and American companies have solid balance sheets, with no significant supply excesses except in offices, something that will tend to limit how much corporate investment can decelerate. At the same time financial conditions are not highly restrictive, with long-term real rates relatively high but credit spreads and equity risk premiums in “accommodative” territory.

With aggregate supply and demand balanced, with demand likely to grow in line with potential, and with well-anchored inflation expectations, core inflation should continue to moderate in the coming months. Additionally, the rental component of the US CPI should improve soon. This context supports the Fed beginning to lower interest rates as early as September to avoid maintaining a restrictive policy for too long, which could unnecessarily increase unemployment.

Unless the situation in France becomes more disruptive than anticipated, we expect Eurozone economic activity to moderately accelerate in the coming months. Private consumption has solid fundamentals, with wages growing above inflation, historic low unemployment, and strong net wealth on the part of households. Fiscal policy remains expansionary this fiscal year. The industry should benefit from the likely end of the ongoing inventory adjustment process in the second half of the year. Financial conditions are not specially restrictive, with long-term risk-free real rates near zero, and low credit spreads and equity risk premiums.

Equities: The central macro scenario is positive, so a prudent exposure to equities is advisable. We favor balanced positions between value and growth stocks, with cyclical stocks, especially in Europe, potentially outperforming defensive ones during the rest of 2024. European equities are preferred over American due to better growth prospects and valuations. Small companies should perform well with sustained growth and moderating inflation and interest rates. Some exposure to emerging Asian equities, including China, is recommended, but avoid overweighting China due to potential geopolitical risks.

Government Bonds: We remain cautious about long-term US rates due to potential upward pressures from fiscal conditions and inflation risks. German medium and long-term rates seem too low given the Eurozone’s recovery. At the same time fiscal issues in some countries in the Eurozone could lead to spread widening. In Japan, the BOJ is unlikely to tolerate 10-year yields significantly above 1.10-1.20% in the short termdue to modest growth and inflation.

Corporate Bonds: We favor credit due to healthy company balance sheets and low default rates in a no-recession scenario. Given compressed spreads, combining credit exposure with selected local currency emerging market debt is wise. This asset class offers good returns and potential currency appreciation. Emerging countries with high growth rates, solid governance, low deficits, and controlled inflation are now less risky than in the past. Moreover, the US economy’s steady growth and declining inflation should favor emerging market currencies.

Currencies: The ECB’s dovish stance should weaken the euro, though not necessarily against the dollar, given the Fed’s expected rate cuts. We favor AUD, NOK, GBP, CAD, and NZD for their high ratings, positive carry against the EUR, and better macro prospects. In the emerging world, we prefer currencies with good governance, high carry, andsolid growth prospects, such as BRL, INR, MXN, and IDR.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.