Macro Update – January 2025

Macro Update – January 2025

Recent market trends have highlighted the risks of aggressive U.S. trade policies, prompting expectations of a more measured approach that avoids a deep trade war. This paves the way for a broadly positive global economic outlook in 2025, supported by recovering demand, stable inflation, and strategic policy adjustments in key regions. However, tighter financial conditions in the U.S. and ongoing uncertainties around geopolitical and economic risks remain critical factors to monitor.

Given this outlook, we continue to favor a combination of offensive positions, which benefit from our central scenario, with explicit protections to mitigate potential adverse outcomes. Specifically, for defensive assets, we currently prefer long-duration positions over the dollar at the start of 2025.

U.S.

Financial conditions have recently tightened, which should help moderate aggregate demand (bringing it in line with potential growth rates) and, in turn, create conditions for inflation to converge to the 2% target by 2025.

Eurozone

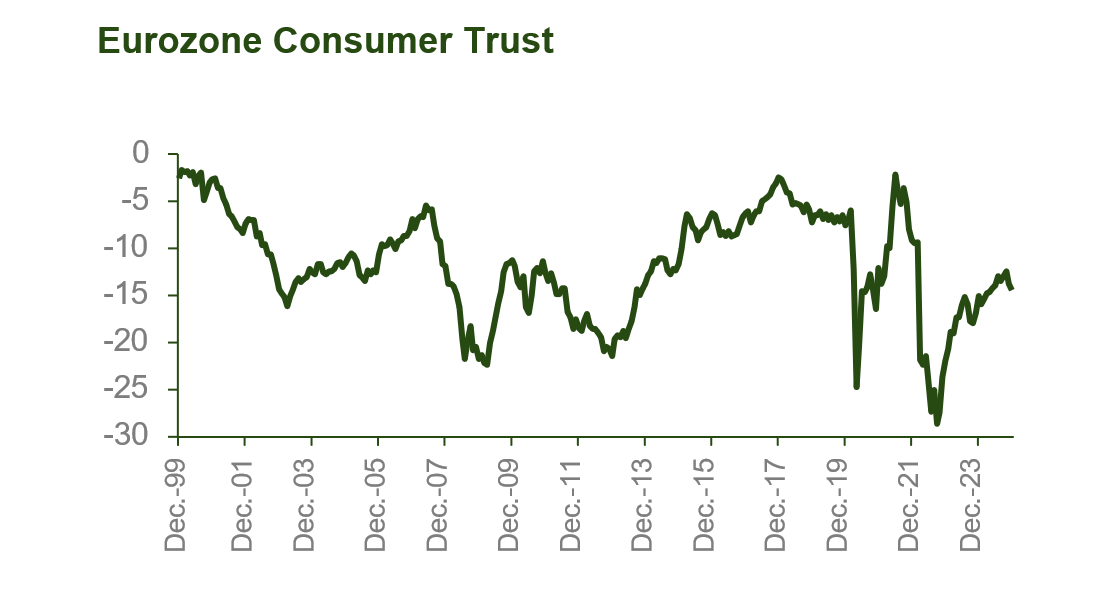

After a rather disappointing 2024, we expect signs of economic recovery this year. Private consumption is well-supported; upcoming elections in Germany could pave the way for more growth-friendly policies; the new European Commission is signaling greater regulatory and strategic pragmatism; long-term real interest rates are very low; and the euro has significantly weakened against the dollar.

Japan

We expect slightly above-potential economic growth in the coming quarters, with wages outpacing inflation and the Bank of Japan gradually but cautiously normalizing its monetary policy.

Emerging Asia ex-China

2025 is expected to be another year of strong growth and notable price stability for the region.

China

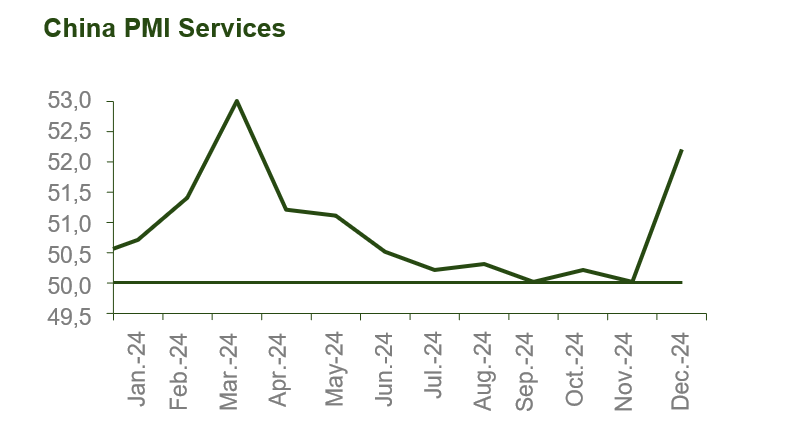

With authorities clearly committed to implementing all necessary stimuli and focusing increasingly on boosting private consumption, we anticipate a growth rate of around 5% in 2025, similar to 2024.

Equities: We maintain a moderately constructive stance, favoring balanced exposure to U.S. and Eurozone markets, emerging Asia, U.K. and Japan, with a focus on U.S. small- and mid-cap companies and European cyclical stocks.

Government bonds: We recommend using duration as a hedge, favoring U.S. 5-year Treasuries and 10-year bonds in fiscally sound countries like Australia, New Zealand, and Germany.

Corporate bonds: Focus on high-quality corporate bonds with short maturities due to tight credit spreads.

Currencies: We prefer high-carry developed market currencies (AUD, NZD, GBP, NOK, SEK, CAD) and select emerging market currencies (INR, IDR, cautiously MXN) over the USD.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.