Key outtakes from yesterday’s ECB meeting

The European Central Bank (ECB) has strongly indicated a likely reduction in interest rates at its forthcoming meeting in June, with some members already advocating for immediate rate cuts.

Adding further detail:

- Christine Lagarde, President of the ECB, expressed satisfaction with the emerging signs of wage moderation and noted that companies are successfully absorbing some past increases in costs. She also highlighted an improving balance between supply and demand in the labor market, which enhances confidence that wage moderation will persist in the near term. Notably, this equilibrium is being achieved through a reduction in job vacancies rather than job losses, presenting a particularly positive outlook.

- Lagarde also suggested that fluctuations in inflation could occur in the coming months due to base effects related to energy prices. She implied that even if upcoming data slightly worsens, a rate cut in June remains probable.

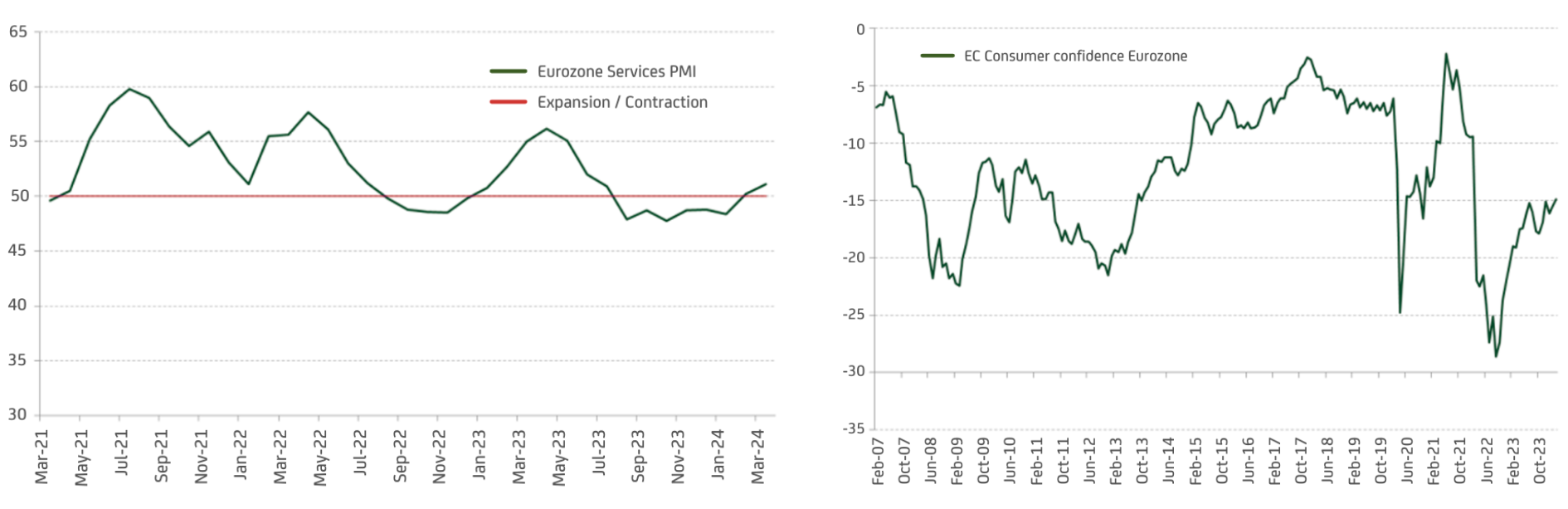

In summary, the ECB is keen on reducing rates in June, barring any significant, unforeseen changes in inflation or wage trends. Looking beyond the immediate future, we anticipate a gradual recovery in Eurozone growth, which might lead the ECB to implement fewer rate cuts than initially expected. From the perspective of risk assets, the situation appears favorable for now.