Macro Update – May 2025

Macro Update – May 2025

Trump’s partial rollback of tariff pressure — prompted by early signs of weakness in the U.S. economy — is a clearly positive development for global markets. However, given the administration’s need to finance at least part of the promised 2026 tax cuts, a full reversal of tariffs seems highly unlikely. We maintain our central scenario: an average tariff increase of around 10%, with significantly higher levels still applied to China (albeit below current figures), and elevated rates for sectors deemed “strategic.”

This more “moderate” approach reduces recession risk, but we continue to view the U.S. as the most vulnerable major economy for the rest of the year. Tariffs act as a distortionary tax, curbing growth and adding short-term inflationary pressure. Trump’s policies are also injecting significant uncertainty into the economy, weighing on sentiment. On top of that, we see a growing risk that markets could begin to question the sustainability of U.S. fiscal policy, particularly if costly tax cuts remain on the table despite an already outsized public deficit.

Outside the U.S., tariffs will also weigh on growth, mainly through weaker exports, but are likely to help reduce inflation. This divergence should give non-U.S. central banks significantly more flexibility to ease. While U.S. fiscal policy looks set to tighten (via spending cuts and tariff-induced tax hikes), most other major economies are pursuing neutral or expansionary fiscal strategies. China and Germany remain the clearest examples of the latter.

Europe

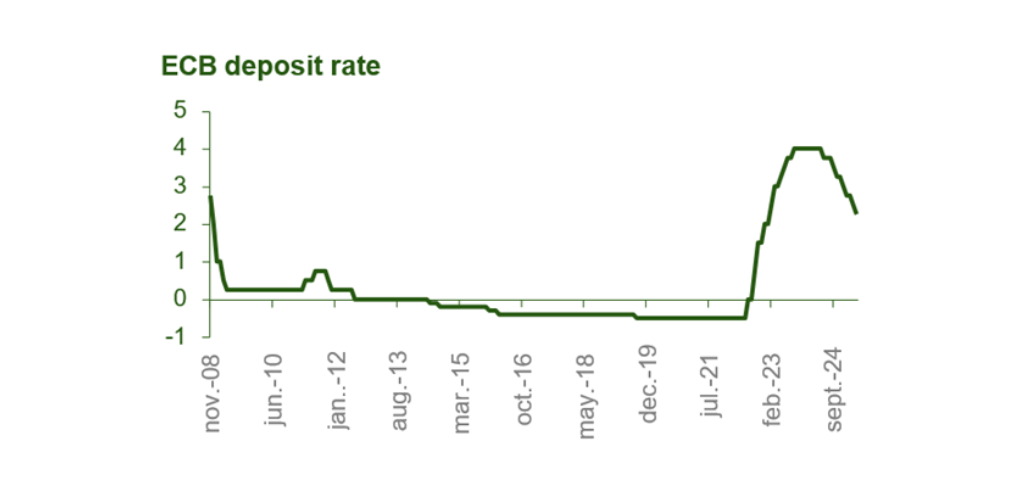

Falling inflation expectations and a resilient growth outlook in core European economies are giving the ECB room to ease. Combined with already low real rates and prospective fiscal stimulus in Germany, this supports our constructive view on European risk assets heading into year-end.

Eurozone inflation is likely to fall further in the coming months, for several reasons:

- The lack of retaliation to U.S. tariffs makes them effectively a demand shock via reduced exports, lowering growth and inflation.

- Euro appreciation and declining oil prices are reinforcing disinflationary forces.

- Wage moderation in the region should help ease services inflation throughout 2025.

China & Emerging Asia

China is unlikely to hit its 5% growth target this year amid the trade war, but several factors should support a respectable pace of expansion:

- Targeted fiscal stimulus continues to favour domestic consumption.

- Reserve requirement cuts are likely in the near term.

- Signs of stabilization are emerging in the real estate sector.

Meanwhile, a reopening of trade negotiations between China and the U.S. looks increasingly likely, potentially leading to significantly lower tariff levels.

In the broader EM Asia region, the outlook remains relatively constructive:

- Growth is holding up.

- Inflation is under control.

- Fiscal and debt positions are generally sound.

- These economies may be less exposed to tariffs than China and could benefit from trade diversion.

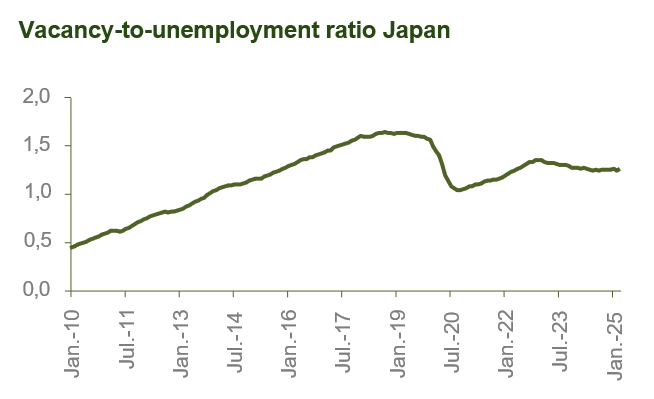

Japan

We maintain a positive view on the Japanese economy. Rising real wages are expected to fuel domestic consumption, and the output gap has turned positive. These conditions — alongside rising inflation expectations — are conducive to inflation stabilizing around 2% over the next 12 months.

A trade deal with the U.S. could be forthcoming, reducing uncertainty. If so, the Bank of Japan may soon resume rate hikes after recent caution driven by tariff risks.

Market Outlook & Asset Allocation

Despite clear risks, our central scenario (especially outside the U.S.) remains broadly constructive. We continue to favour a balanced allocation strategy that blends upside participation with risk mitigation.

Our positioning across asset classes:

- Equities: Overweight Europe and Asia vs. U.S. We believe Trump’s tariff policy justifies a risk premium on U.S. assets, including equities, Treasuries, and the dollar.

- Rates: Long-duration exposure in countries with sound fiscal paths, controlled inflation, attractive real rates, and minimal fiscal stimulus risk (e.g., Australia, UK, New Zealand).

- FX: Short USD vs. JPY and EUR, as a hedge against renewed trade or fiscal shocks, or political attacks on the Fed.

- Diversified FX exposure: Favoring currencies with strong fundamentals and resilient macro conditions.

- Credit: Preference for high-grade, short-maturity bonds to retain flexibility in an uncertain rate environment.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.