Macro Update – June 2025

Macro Update – June 2025

Despite ongoing uncertainty surrounding U.S. trade and fiscal policy, a moderately constructive global scenario remains our base case – provided tariff increases remain around the 10-15% range and the eventual fiscal package is seen as credible by markets.

However, risks are mounting. The structural deficit exceeds 6% of GDP, and the trajectory of U.S. debt is raising growing concern among investors. Even in the absence of further fiscal deterioration, the underlying equilibrium remains fragile. The risk premium on U.S. assets – including equities, Treasuries, and the dollar – continues to rise, driven not only by fiscal concerns but also by the volatility of political decision-making.

Tariffs function as a distortionary tax, introducing inflationary pressure in the short term while weighing on growth. The result is a policy mix that leaves little room for monetary easing, in stark contrast to most other major economies.

Europe

Falling inflation across the Eurozone and relative macroeconomic resilience – especially in core economies – are giving the ECB space to ease policy.

Lower oil prices (in euro terms), euro appreciation, and wage moderation are all reinforcing disinflationary dynamics. At the same time, countries like Germany are preparing modest fiscal support, offering a tailwind to risk assets in the second half of the year.

ECB Deposit Rate

China & Emerging Asia

Despite headwinds from elevated U.S. tariffs, China is showing signs of stabilization. Fiscal and monetary authorities have demonstrated a clear commitment to supporting domestic demand, and the housing market appears to be bottoming out.

We expect Chinese growth to remain above 4% in 2025, underpinned by:

-

Continued fiscal and monetary stimulus

-

Improving consumption dynamics

-

Potential re-engagement on trade with the U.S.

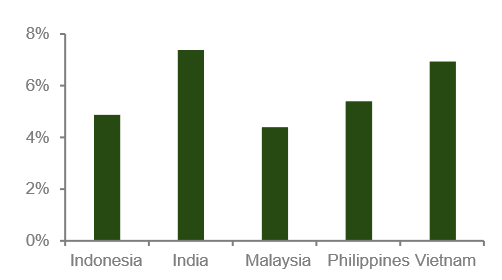

Elsewhere in emerging Asia, the macro environment remains favorable. Economies such as India, Indonesia, and Vietnam continue to post solid growth, with relatively strong external balances, low inflation, and policy flexibility.

Emerging Asia GDP Growth (YoY)

Japan

Rising wages and a positive output gap are supporting domestic consumption and helping anchor inflation near the Bank of Japan’s 2% target.

This could create room for further monetary policy normalization — particularly if global tariff risks remain contained. Still, Japan’s high public debt remains a key vulnerability, especially in an environment where markets are increasingly sensitive to fiscal sustainability.

Year-on-Year Services Inflation in Japan

Market Outlook & Asset Allocation

Equities

We maintain a selective and risk-aware stance. After a strong rebound in recent weeks, valuations have become more demanding, particularly in the U.S. We continue to favor European and Asian equities over their American counterparts.

Government Bonds

We remain cautious on U.S. Treasuries given persistent fiscal imbalances and tariff-driven inflation risks. In contrast, we favor long-duration bonds in countries with solid fiscal frameworks, easing inflation, and limited fiscal expansion plans.

Corporate Credit

Corporate fundamentals – especially in Europe – remain strong. While credit spreads are tight, we see value in high-quality issuers offering stable carry over aggressive duration or credit risk strategies.

Currencies

We remain negative on the U.S. dollar, reflecting both cyclical and structural concerns. The dollar’s safe-haven status is increasingly in question amid fiscal stress and policy unpredictability.

Our preference is for currencies with sustainable carry and solid macro foundations, such as those of India, Indonesia, Australia, New Zealand, the UK, and Norway.

This report has been prepared by AMCHOR Investment Strategies SGIIC, S.A. (“AMCHOR IS”) an entity participated by the Alantra Group and incorporated as an investment firm authorized and supervised by the CNMV, registration number 273 with registered office at Calle Velázquez Nº 166, 28002 Madrid (Spain).

This report is addressed only to professional investors for internal and exclusive use. The information contained herein shall only be distributed as permitted by applicable law and AMCHOR IS and the Alantra Group specifically forbid the redistribution of this document in whole or in part without its prior written permission.

Nothing in this report constitutes a representation from AMCHOR IS or the Alantra Group that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor it is intended to be a complete statement or summary of the securities or financial markets referred to in this report.

AMCHOR IS and the Alantra Group do not (i) endorse, guarantee nor represent that investors will obtain profits nor (ii) accept any liability for any investment that the recipients may carry out and incur in losses arising from adopting the recommendations included in this report or its contents. Investments involve risks and investors should exercise prudence in making their investment decisions. This information has been extracted from public sources that AMCHOR IS considers reliable and is not responsible for its truthfulness or accuracy. This report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change. The analysis contained herein is based on numerous assumptions, hypothesis and forecasts. Different assumptions could result in materially different results. AMCHOR IS and the Alantra Group are under no obligation or keep current the information contained in this report.

The investor should note that the financial market is fluctuating and as such is subject to variations. The price of investments (which may be quoted in illiquid markets) may change and the investor may not get back the amount initially invested. The figures contained herein relate to the past. Past performance is not a reliable indicator of future results.