Alantra’s Perspectives on the EU Securitisation Regulation Amendments

Date 17 June 2025

Type Investment Banking

The draft amendments to the EU Securitisation Regulation and associated CRR provisions, published here, materially enhance the Significant Risk Transfer (SRT) framework.

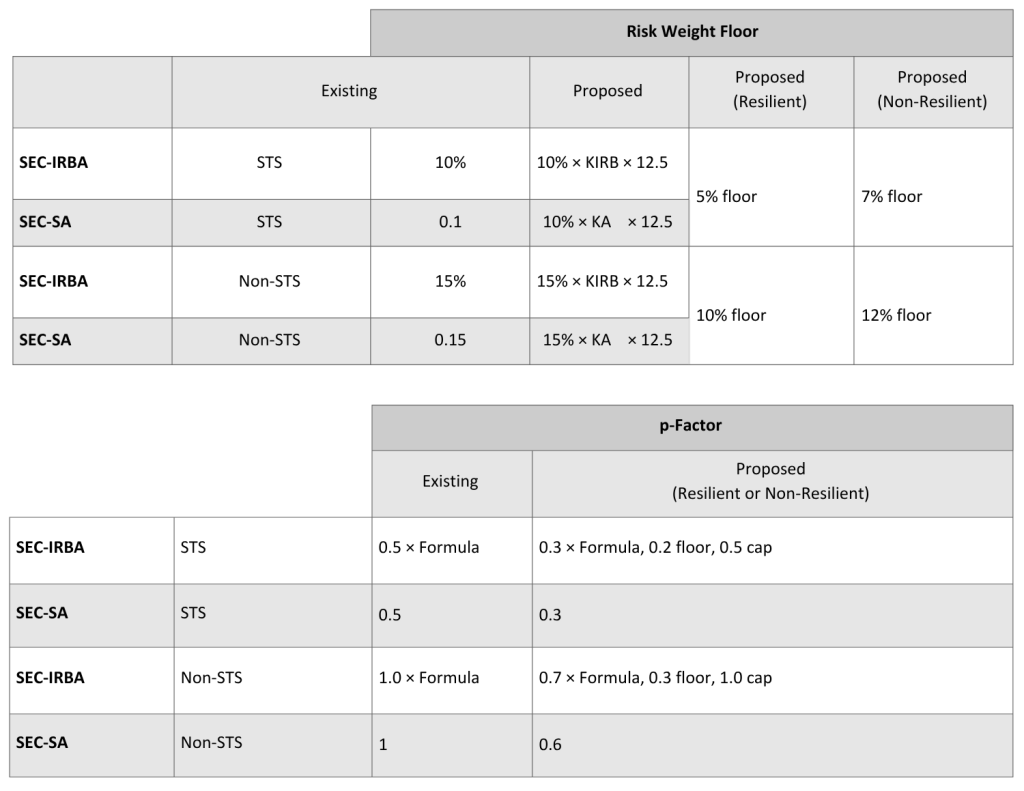

They broaden eligible reference assets, recalibrate risk-weight floors and p-factors, create a “resilient” SRT category, and recognise highly rated (re)insurers as eligible guarantors for STS transactions (albeit not for resilient ones). Taken together, these measures substantially strengthen the toolkit available to both IRB and standardised banks for capital-management purposes.

Key Regulator Changes

Strategic Impact for Banks

- Capital efficiency – Internal modelling indicates IRB mortgage pools can achieve 65 – 75 % CET1 relief post-amendment, compared with negligible benefit under the previous 10 % floor.

- Valuation benefits from ROTE enhancement – Lower capital intensity raises return on tangible equity; embedded credit-risk mitigation supports external ratings, reducing wholesale funding spreads. For growth-oriented institutions, SRT therefore acts as a facilitator of cheaper capital and an accelerator toward IPO readiness.

- Balance-sheet redeployment – Freed capital can be recycled into priority segments (SME, housing, green infrastructure), supporting EU policy objectives while maintaining risk discipline.

Prudential Constraints Going Forward

While the amendments ease risk-weighted capital consumption, the leverage ratio (LR) could then become the binding constraint for banks with sizeable low-RWA books. Preliminary analyses indicate LR headroom may be the key variable when sizing future SRT issuance programmes.

Closing Observations

The revised framework positions SRT as a practical and regulator-supported mechanism for aligning capital resources with asset-growth ambitions. If the proposal is implemented, for both IRB and – significantly – Standardised Banks, securitisation would offer a scalable means to optimise capital, diversify risk transfer, and attract commensurate institutional liquidity. Continued engagement with forthcoming Level 2 measures (EBA RTS and guidelines) will be essential to realise the full strategic and valuation benefits outlined above.

Summary of Specific Key Details of the Proposed Legislation

For the retained senior position in a synthetic securitisation, the new treatment would be as follows, with the points of difference between resilient and non-resilient highlighted: