Digital transformation – pervasive, structural growth

Date 15 July 2021

Type Alternative Asset Management

As we look into 2H21, we expect continued macroeconomic uncertainties, political concerns, vaccination rates and mutations to have an impact on markets. We remain focused on fundamentals, and as we approach the middle of the year, one overriding theme that we believe is worth monitoring is the evidence of the enduring effects of the pandemic resulting in an acceleration in digital transformation. If there is one over-arching conclusion for 2H21 and beyond, it is that, ultimately, much of the socioeconomic change in behaviour will prove permanent. In the next decade(s), we believe we will look back at this period as an accelerant of digital adoption; history in fact teaches us that other periods of severe crises (WWII, 9/11 and the GFC) have been catalysts for the adoption of new technologies. Here we present the first in a series of post that highlights the mounting evidence.

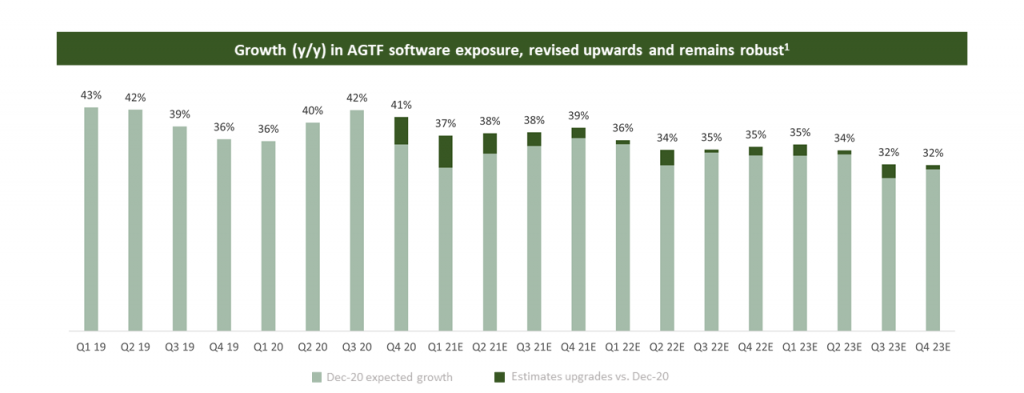

The need to have corporate information and data available is now essential in any working environment for companies to transact and consumers to take decisions. This shift is affecting every industry and accounts for as much as 70% of the AGTF portfolio when we take a broader definition, impacting primarily our software investments. The growth is not just from Work from Home (WFH) technologies, but we would argue there is a broad layer of technologies aimed around digitally transforming entire industries, which support our investments. Software typically represents around 50% of the portfolio; we view our exposure as a good read on digital transformation overlapping with several themes, such as Cloud Infrastructure, Cybersecurity, AI and Big Data. In the chart below, we show the revenue growth rate of software holdings has increased vs our expectations in December 2020. Pre-Covid, this theme had a consistent growth rate of 30-40%+, which accelerated in 2020 driven by the pandemic. Impressively, growth rates expected for 2021 have recently seen strong revisions upwards, even when compared the accelerated growth last year.

Source: AGTF. Calculated as a weighted average of quarterly y/y growth of the AGTF portfolio’s software companies. (1) Revision of growth estimates don’t reflect any change in weights and/or positions in the portfolio, it is a like-for-like comparison of the portfolio estimates as of the end of December 2020 vs June 2021.

The level of sustained growth highlights the underlying importance of this trend, which continues to form a key part of the AGTF portfolio strategy.

Alantra Global Technology Fund Team

*This article is an extract from the fund’s 2021 outlook letter. If you would like to be added to the fund’s distribution list contact [email protected]

This is article contains information (the “Information”) of Alantra Global Technology Fund (hereinafter, the “Fund”), a subfund of Canepa Funds ICAV, and it has been prepared by Alantra EQMC Asset Management, SGIIC, S.A. (hereinafter, “Alantra AM”). Alantra AM has not obtained an independent verification regarding the accuracy and integrity of the information used, nor a confirmation of the reasonability of the hypothesis considered. The Information has implicit subjective judgements. In particular, most of the criteria are based in estimates of the Fund’s future results. Considering the inherent uncertainties regarding any information concerning the future, some of these hypotheses may not materialize as defined.

The Information is not an offer to buy, sell or subscribe for securities or financial instruments and is not intended to be investment advice. Any decision to buy or sell securities issued by the Fund subject to this Presentation should be based on the legal documentation of the relevant Fund, in particular the subscription agreement and the prospectus of the Fund and the Key Investor Information Document (KIID) as it is filed with the applicable regulatory authorities from time to time, or on publicly available information on the related companies. The recipients of the Information must bear in mind that the securities or instruments discussed in herein may not be suitable for their investment objectives or financial circumstances, and past performance should not be taken as a guarantee of future performance. The Fund is an UCITS fund under the 2009/65/EC Directive.

In light of the above, neither Alantra AM, its officers, directors or employees, or its shareholders, may be held in any way liable for damages that could arise, directly or indirectly, as a result of decisions taken on the basis of this Information or any use given it by its recipients.