Alantra ranks amongst Top 5 independent advisors to Private Equity Houses across the globe

Date 3 February 2021

Type Investment Banking

- Alantra has ranked #5 independent advisor in the Global league table in 2020 as well as #2 independent advisor in Europe, according to Mergermarket.

- Intense activity in the most active sectors in global M&A in 2020. Alantra’s technology team advised on a total of 28 deals throughout the year, 14 of which involved private equity houses, equating to 30% of the firm’s activity with private equity houses and 12% of this year’s overall activity for Alantra. In healthcare, the firm advised on 23 transactions valued in over €6bn.

- Alantra has also ranked amongst top 5 independent advisors in Europe and in the UK by number of deals advised.

Alantra, the global mid-market investment banking and asset management specialist, has ranked amongst the top 5 independent advisors to Private Equity Houses by number of deals advised in the global league table in 2020, as well as #2 independent advisor in Europe, according to Mergermarket. Alantra also positioned itself amongst top 5 independent advisors in Europe and in the UK by number of deals advised.

On deal count globally, the value of private equity houses buyout activity in 2020 has recorded the highest annual figure since the global financial crisis in 2008-09, with $608.7bn across 3,509 deals, according to Mergermarket. Technology and Healthcare sectors generated the highest amount of activity, areas in which Alantra has a wealth of knowledge and experience.

Alantra’s Technology team advised on a total of 28 deals valued at over €4bn in 2020, 14 of which included private equity houses, which represents 30% of the firm’s private equity houses activity and 12% of the year’s overall activity for Alantra. The firm’s technology team comprises over 30 bankers and is already among the main independent advisors in Europe. Alantra’s healthcare team advised on 23 transactions valued in over €6bn last year.

Miguel Hernández, Managing Partner and Head of Investment Banking at Alantra, commented: “Despite all pandemic-related challenges in 2020, there has been abundant market liquidity and the funds have taken a more pragmatic approach when executing transactions. This has enabled them to achieve record numbers in M&A activity globally, specifically with regards to acquisitions.”

“Our in-depth understanding of the needs and interests of the major private equity houses globally has contributed to our success this year, which has allowed us to drive investment opportunities both in niche markets that can weather the current economic context and in sectors with high growth potential, such as technology or healthcare, where Alantra has a high level of specialisation”, adds Hernández.

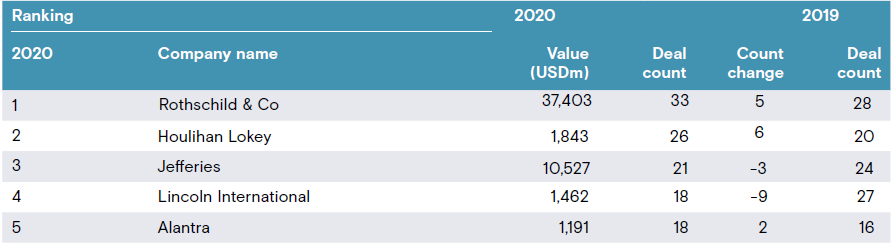

Global Buyouts league table by deal count 1

1Mergermarket league table (by volume) of financial advising on announced transactions across the globe in 2020. The ranking includes only independent advisory firms. Full rankings are available here: https://www.mergermarket.com/info/2020-global-ma-report-legal-league-tables

Alantra’s rise in M&A rankings reflects the resilience of its specialised and diverse service offering against a challenging economic backdrop. In 2020, Alantra advised on 120 transactions, of which 73 were M&A. Noteworthy transactions include (clients in italics): Embracer Group’s €525m acquisition of Saber Interactive; CMC Group’s sale to KKR; Inflexion’s acquisition of Aspen Pumps; Six’s €2.8bn takeover for Spain’s Stock Exchange operator BME; Bridgepoint’s acquisition of PharmaZell; Optimus Holding’s on the acquisition of OM Pharma from Vifor Pharma and EQT’s acquisition of Colisée.

Alantra’s strong track record gained recognition at the Unquote British Private Equity Awards, at which Alantra was named “Corporate Finance Adviser of the Year 2020”. The awards, which are judged by a panel of industry veterans from the financial community combined with a public vote, celebrate innovation, resilience and excellence within the UK private equity industry.