Alantra ranks #5 advisor globally in buyouts in Q1 2019, according to Mergermarket

Date 15 April 2019

Type Investment Banking

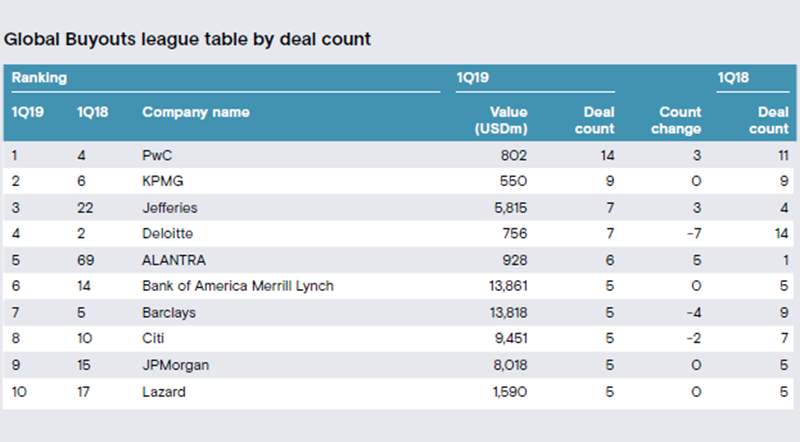

Madrid – Alantra, the global mid-market investment banking and asset management specialist, has ranked as #5 advisor by number of deals in the global buyouts league table for Q1 2019, according to Mergermarket. The ranking recognizes the involvement of advisors in bidding situations across the globe.

In Q1 2019 Alantra also ranked as #6 independent advisor by number of deals in Europe and #3 in France, all by deal count[1]. Noteworthy transactions in Q1 include: the acquisition of a majority stake in Hana Group by Permira, the sale of Dubai-based The Nobu Group to Tubacex and Senaat, the sale of Presco Polymers to River Associates, the acquisition of a minority stake in bee2link by Bridgepoint, the acquisition of a majority stake in aeronautics Group Revima by Ardian, and the sale of US-based repair outfit iCracked to The Allstate Corporation.

This adds up to the recent nomination as best Pan-European advisor of the year 2018 in the Private Equity Awards, organized by Real Deals. In that period, Alantra advised in c. 100 M&A deals for a total value of over €10Bn.

The shortlist of the award is formed by Alantra, Baird, Clearwater International, DC Advisory, GCA Altium, PwC, Rothschild, William Blair. The ceremony of these Awards, which are amongst the most respected accolades in the private equity industry in Europe, will take place on 24 April 2019 in London.

[1] https://trendreports.mergermarket.com/reports/500ce96c-7150-470f-8c38-0f2eaf5291d9