Alantra generated revenues of €204.4m (+82.6%) and net profit of €36.0m (+139.4%) in the first nine months of 2021

Date 28 October 2021

Type Financial Results

- Results in the first nine months evidenced continued strong performance across all businesses and regions, with net revenues of €204.4m (+82.6% YoY).

- Investment Banking generated its highest net revenues of €136.4m (+81.2%), reflecting strong market momentum.

- In Asset Management, revenues increased by 75.5% to €34.3m, driven by steady growth in fee-earning assets under management (+16.6%) and success fees (€13.2m) generated in H1.

- Credit Portfolio Advisory generated revenues of €33.5m (+110.1%) due to a recovery of NPL deal activity.

- All regions delivered superior results, with six markets (France, Germany, Spain, Switzerland, the UK and the US) contributing at least €15m in revenues.

- Operating expenses amounted to €152.3m (+64.4% YoY) due to higher retribution (+240.9%) driven by strong business performance. The Group continued to invest in the growth of the business, increasing fixed personnel expenses and other operating expenses by 8.6% and 36.3%, respectively.

- As a result, net profit attributable to the parent reached €36.0m (+139.4% YoY), of which €36.7m (+158.2%) correspond to the fee business, €0.4m to the portfolio and -€1.1m to other results.

- Alantra maintains its strong balance sheet, with €276.0m of shareholders’ equity attributable to the parent; €220.3m in cash, cash equivalents and a monetary fund; €53.6m portfolio of investments in products managed by the Group; and no financial leverage.

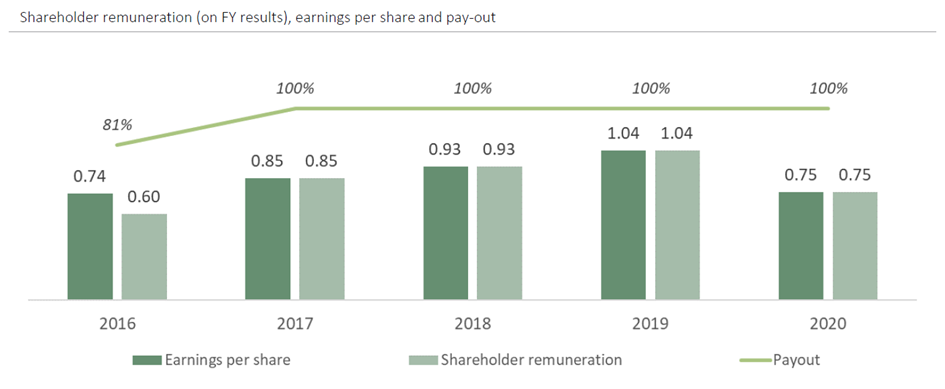

- The Board of Directors has approved the payment of an additional €0.35 per share, which will be paid on 12 November 2021. Factoring the dividend of €0.40 per share paid in May 2021, the Group will fully distribute the 2020 consolidated net profit (€0.75 per share).

- The Investment Banking division advised on 147 transactions (+79.2%) worth c. €16.8bn year-to-date and continued to strengthen its specialized global offering by hiring five senior professionals. Noteworthy transactions include the partnership between Foster+Partners and Hennick & Company; the acquisition of three businesses of the Chinese-listed company Saurer in Europe by the Swiss-listed company Rieter; the sale of Hairburst to JD Sports; the divestment of Aryzta’s operations in North America (to Lindsay Goldberg for €850m) and Brazil (to Grupo Bimbo); and advising in four transactions for global ceramic sanitaryware and fittings producer Roca Group, including the sale Tile division to Grupo Lamosa for $260m. As a result of this performance, Alantra ranked as the #1 Independent advisor to PE in Europe and #3 Independent advisor in Europe by the number of deals advised.

- Alantra launched four new strategies in Asset Management and achieved superior returns. The Firm increased capital commitments in its Real Estate Debt (€132m), Energy Transition (€81m), Solar Energy (€40m); and Global Technology (€34m) strategies. Alantra also announced the incorporation of Daniel Gálvez to head its Real Estate practice.

- Alantra’s Credit Portfolio Advisory division has advised on 39 transactions (+77.2%) worth over €39.8bn, including advising Alphabank on the second-largest rated NPE securitization in Europe (Project Galaxy, €10.8bn); Eurobank on the third-largest rated NPE securitization in Greece (Project Mexico, €5.2bn); Cajamar on the largest NPL sale in Spain since the outbreak of COVID19 (€500m); and UniCredit on the sale of a €500m unsecured NPL portfolio in Italy.