Alantra achieved revenues of €214.2 million (+6.6%) and net profit of €40.2 million (+14.7%) in 2019

Date 26 February 2020

Type Financial Results

Net revenues increased by +6.6%, up to €214.2m, mainly driven by international expansion of its advisory business (which comprises the investment banking and credit portfolio advisory divisions). This business generated record-revenues of €165.2m (+22.6%) in 22 markets. Alantra was engaged in significant and complex M&A transactions globally, elevating its average fee to €1.1m (+16.1% YoY).

Net revenues from asset management reached €47.5m, which represented a -26.8% decrease compared to previous year, due to a decrease in performance fees (-41.8%) and a change in the consolidation perimeter changed following the Alantra WM deal1. Like-for-like management fees from alternative assets increased by +3.1%.

- Operating expenses amounted to €171.3m (+20.6%), most of it due to the effort carried out by the Group in the international expansion of the Investment Banking and Credit Portfolio Advisory businesses.

- Net profit attributable to the parent reached €40.2m (+14.7%), of which €37.8m derived from the fee business (+22.7%). The Group generated additional profits from portfolio divestments of €1.8m and Other Result of €0.5m.

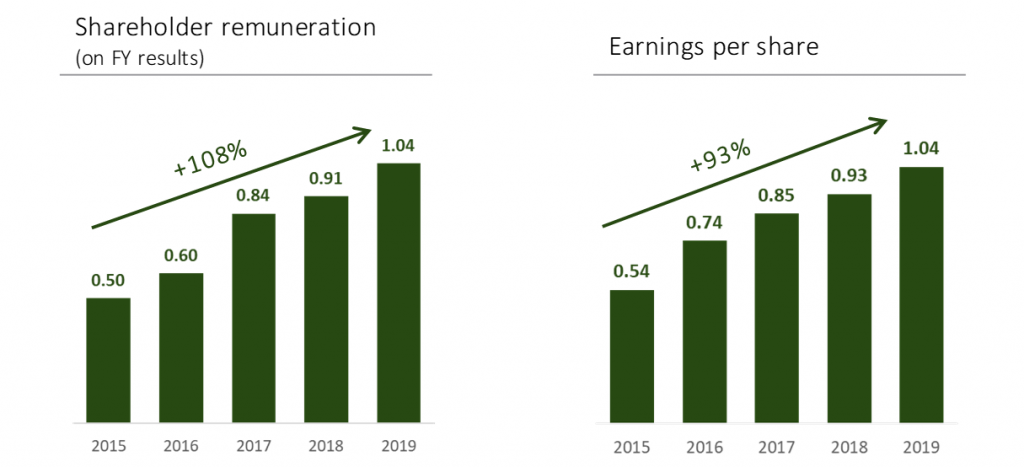

- Alantra to maintain its strong shareholder remuneration policy: The Board of Directors will propose a 100% payout. At the Annual General Meeting (April 2020), the Board of Directors will propose the distribution of an additional payment of €0.44 per share. Factoring in the €0.60 per share interim dividend already paid out in December 2019, shareholder remuneration will total €1.04 per share (+14.2% YoY), amounting to full payout of the consolidated profit and a dividend yield of 6.9%.2

- International growth and diversification of the investment banking activity. In 2019, Alantra advised on 161 transactions (+5% YoY), out of which 54% were in M&A, 24% in ECM, 15% in debt and 7% in strategic advisory. As part of the effort to further increase its global presence and sector specialization, the Group opened new offices in Hong Kong, Copenhagen and Chicago and added an MD in London to reinforce its global Chemicals practice.

Alantra won the Pan-European Corporate Finance House of the Year 2019 in the Private Equity Awards as a recognition for the expansion of the firm as well as the value created for its clients across Europe.

- The Credit Portfolio Advisory division advised in over 40 deals for a total volume of €36bn.

The Group completed the integration of the KPMG UK team incorporated in July 2018 and strengthened its hubs in Ireland, Italy, Portugal and Greece. This division is the leading advisor to financial institutions, platforms, investors and financiers for credit and real estate portfolios across Europe, with over 180 professionals devoted to this service in six countries.

Finally, Alantra acquired a majority stake in urbanData Analytics, a proptech firm that pioneers the use of big data artificial intelligence in the real estate sector.

- Additional steps towards growing its asset management business by incorporating new strategies, raising new funds and completing the acquisition of a strategic stake in Access Capital Partners, a leading independent European private asset manager with €10.7bn of cumulated assets raised during its 20-year history.

Alantra entered Venture Capital through the acquisition of a strategic stake in Asabys Partners, a Pan-European Venture Capital firm specialized in investments in the life sciences and health sectors, and the reinforcement of its Real Estate practice with the incorporation of a new team led by Juan Velayos.

The Private Equity, Private Debt and Real Estate divisions completed a total of 6 investments, 2 add-ons and 1 divestment during the year.

The Group completed the fundraising of a new private debt fund and started the fundraising of a new real estate private debt fund. Total assets under management in direct investments stood at €2.3bn.

1) Alantra Wealth Management is consolidated under the equity method since June 2019

2) The 2019 dividend yield has been calculated dividing the dividend per share corresponding to 2019 by the average closing share price during 2019 (14.62 euros per share)