TMT Public-Private Markets, the pendulum swings

Date 23 June 2021

Type Alternative Asset Management

Alantra Global Technology Fund (ALGTF ID Equity)

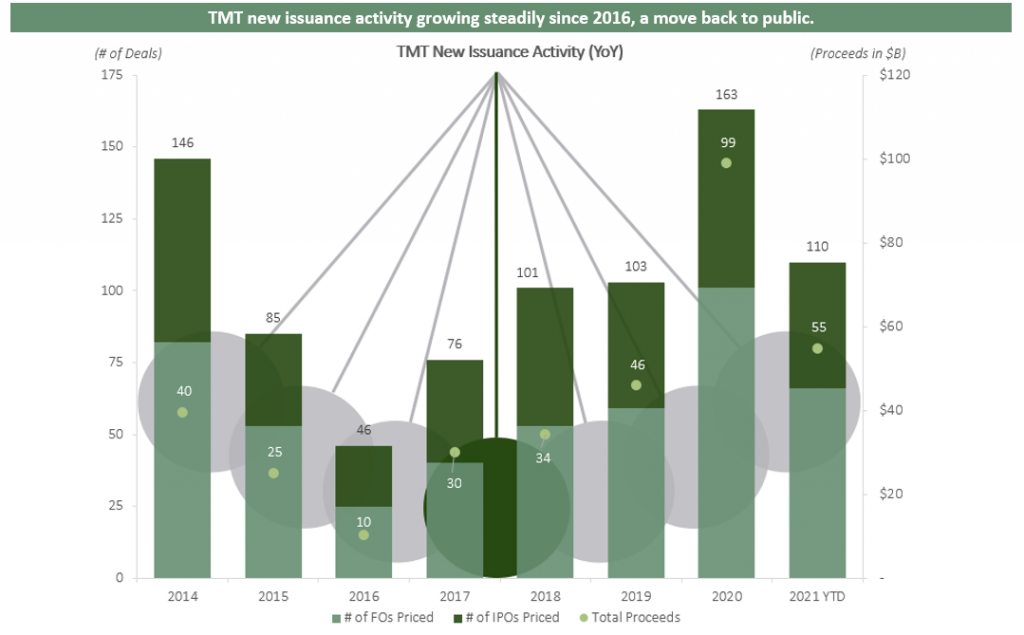

When it comes to value creation in technology, the back and forth between public and private markets has been the most profound in the technology sector over the last few decades. Following the painful 2000 bubble and correction, faster growing, higher risk companies resisted going public for over a decade, while valuations contracted, leaving this option less attractive to founders. This saw a clear shift in value creation, combined with maturing VC and PE asset classes. However, following a shift away from public markets for multiple decades for growth and innovation, we have seen early signs of a slight reversal in recent times. Indeed, 2020 and early 2021 have been marked by a large number of IPO issuances (which have been quite successful), higher levels of M&A and rapidly accelerating growth in special-purpose acquisition company SPAC issuance (discussed below). While we do not expect a return to the levels seen in the 1990s, we believe a multi-year trend of steady new issuance in public markets is a possibility.

The recent correction in fast-growth assets will, no doubt, lead to a much-needed near-term pause. However, the trend suggests the possibility of a shift in opportunities in public markets in the coming years. Traditional VC/PE-backed companies that opt for a traditional IPO will probably have higher quality, whilst SPACs will have the potential to speed up the entry process, aimed at investors with a much higher risk appetite. While not all these developments are positive, we believe they augment opportunities, especially as private companies transition to public markets.

The main conclusion we draw is that for technology investing, the right approach is to follow and perhaps participate in both asset classes. It is, therefore, no surprise that hedge funds, institutional managers and SWFs (sovereign wealth funds) continue their aggressive march into late-stage private investing, while VC and PE look to stretch their current public-market strategies. The high levels of capital in both markets suggest competition for prized assets will likely remain fierce.

How did we arrive here? We observed two major trends in how public and private markets intersect, especially with respect to the technology sector:

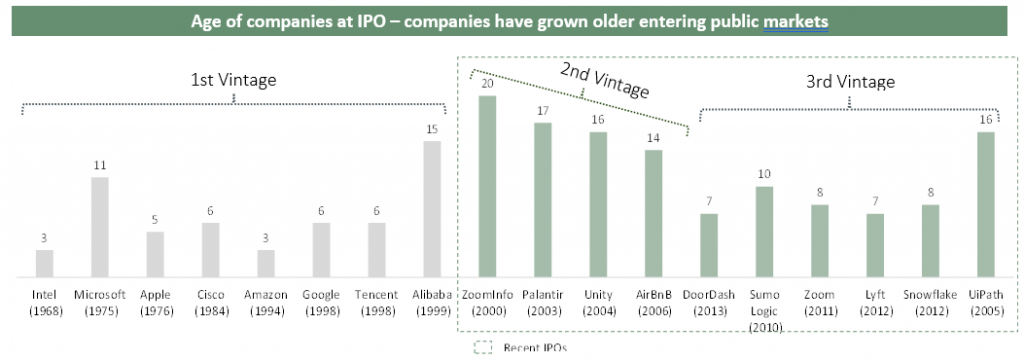

- 1993-2000. During this period, public markets were very hospitable to companies, so companies would go public at $100-500m market cap and prove themselves in the public market – the role of VC was to chiefly participate in Series A, B, and Mezzanine rounds, then all other activity played out in the public markets.

- 2000-2020. A mix of low-quality business models, overvaluation in technology and the consequent 2000 crash, and subsequent reforms saw the pendulum swing the other way. For a long period, public markets became wary of growth investing. At the same time, the growth of private equity and VCs has meant that it has become possible and desirable to wait for IPOs as late as possible. This has translated into the financing of private technology companies, which could see their market valuation in tens of billions of dollars even before allowing the inflow of public capital.

More recently, public markets have appreciated growth; the recent banner year of IPOs suggests this trend will likely sustain. In fact, we believe recent developments mean this is a rapid period of capital markets activity:

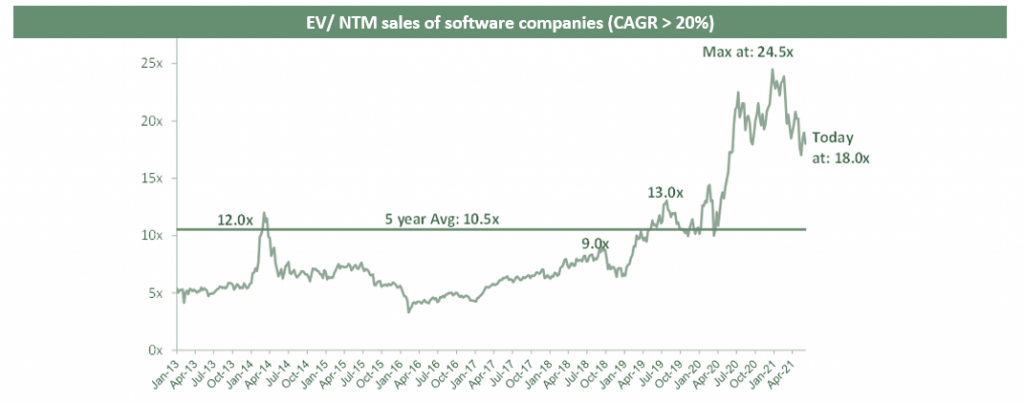

Valuations – Multiples have ramped up. SaaS multiples, for example, are nearly double of what they were in 2016 and significantly higher compared to the 1990s, especially on the high-growth side. This can be explained by the following

- The first reason is the re-rating that took place after the 2000s with the rise of private equity, with some leading PE firms willing to assign a higher terminal value, as software lasted a lot longer than expected. This, coupled with improved visibility and software stickiness, led to DCFs’ assigning a much higher valuation based on the life of these assets.

- The advent of broadband has driven a re-rating in the market size. The question was how many customers were willing to buy software, especially one that could be accessed anywhere in the world. Initially, TAM was a few hundred of the largest businesses, whilst now you have a 100x increase in the end market size. This trend has been proved time and again, with the time taken to reach $1bn of revenue shortening. Given the duration and market size re-rating, it can be claimed that software is an asset with a longer life.

- Appreciation for SAAS business models. It can be argued that in 2020, appreciation for the quality, recurring nature and potential addressable market of SAAS business models was widespread. Clearly, the transition has been accelerated by the pandemic to an extent, but even after the recent pull-back, the multiple remains at healthy levels.

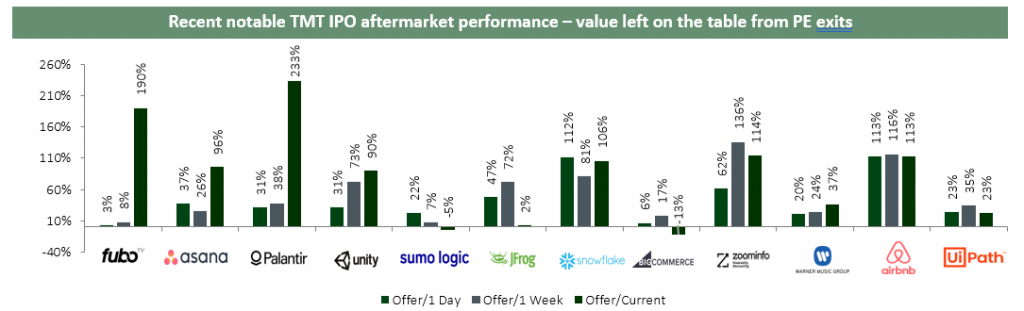

- Recent IPO vintage has been decent, on average. TMT has been fertile ground for IPOs recently. In the US alone, the IPO market has been buoyant, with 52 IPOs launched in 2020, greater than one per week. Three of the largest tech IPOs (Snowflake, Airbnb and DoorDash) were launched in 2020. The market’s appetite for growth, and frankly the quality and scale of some businesses entering the market suggests an ongoing growing level of capital markets activity. Indeed, this year, some high-quality companies entered the stock market which, in our view, could be the next wave of disruptors including ZoomInfo and Snowflake.

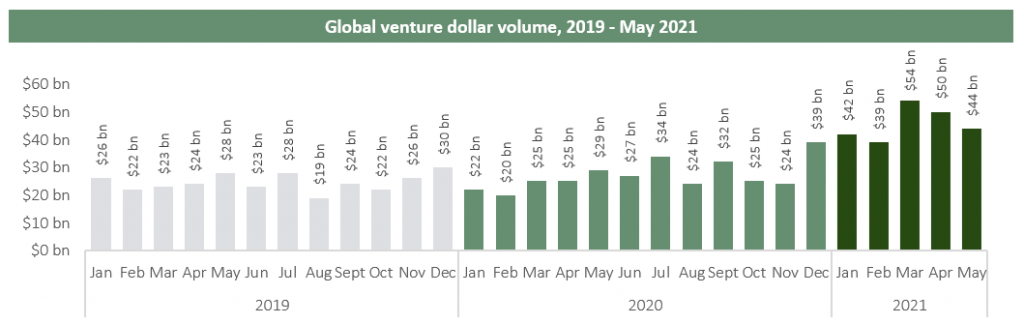

Private markets providing a good backdrop for continued multiple year issuance. We observe that VC funding of $300bn was reported in 2020, growing c.4%. Despite the pandemic, there was actual growth in the funding phase, with the expansion attributed to mainly the growth stage and shorter early stage. What is clear, however, is that there is a lot of funding capacity. The rising value of cloud software companies on public markets this year has been matched by high levels of activity in the private market, creating a wave of valued start-ups. VC and PE, armed with high levels of dry powder, are racing enthusiastically to find the next Snowflake or ZoomInfo. Indeed, as shown below, venture dollar volume year-to-date trends are very strong, up 89% yoy in 2021.

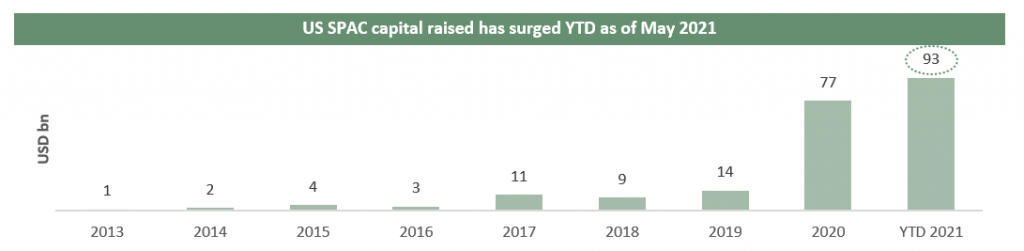

SPACs accelerate entry to public markets, but is it higher quality for investors? Within capital raising circles, 2020 and 2021 will be remembered as the years of the SPAC. A SPAC is a ‘blank-cheque’ company formed to acquire or merge with another company. SPAC management teams have attracted the who’s who in finance and politics, as well as celebrities. The basic idea is that proprietary knowledge, financial acumen and networks of such players will likely assist in sourcing and executing such transactions. A typical SPAC needs to complete an acquisition within two years of raising capital or the capital must be returned to investors. In a typical SPAC set-up, the sponsor raises initial capital by issuing units consisting of 1 share and half or one-third of a warrant. The shares are generally priced at $10, while the warrants are typically struck 15% out of the money ($11.50), with a five-year term and $18 forced exercise. At the time of the announcement of a merger, shareholders typically have a chance to vote and accept a deal. The numbers (shown in the charts below) are noteworthy:

- SPAC IPO proceeds in 2020 totalled over $73bn, a 462% jump vs. $13bn in full-year 2019. After a strong start to 2021, activity has cooled year-to-date, as have share prices. However, we note there are currently around 400 SPACs and with over $120bn in firepower pursuing new targets.

- Increased focus on growth over value stimulated SPAC activity in 2020. The majority of SPAC IPOs completed this year are searching for targets primarily in information technology, healthcare or consumer discretionary. In fact we believe that depending on categorization SPACs, 35-45% of companies have a technology focus.

Are SPACs good for public markets? We believe there are two main consequences of this trend.

- In many cases, the sponsor promotes, and lock-up periods (or the lack thereof) do not exactly create the same levels of alignment with long-term shareholders. This can, in some cases, make the SPAC process short term and transactional.

- The likelihood of the emergence of many more public companies, especially in technology, over the next 12-24 months is high, facilitating fertile ground for a new wave of disruptors to emerge in which public market investors can participate. This should be a positive in the form of increasing opportunities, at least for specialised investors.

- Many of these companies will likely enter the market without the same level of understanding, and possibly different quality thresholds in comparison to traditional IPOs. Indeed, the recent volatility around Nikola and historical performance of SPACs in the past merits closer scrutiny. We note that quality can mean so much here, for example many SPACs come to the market with too little or no revenue.

- We do consider quality and risk. We note the number of billion-dollar-plus listings of zero-revenue companies has surpassed the figure in the dot-com bubble era thanks to SPACs. In other words, the current raft of issuances from SPACs and many new hyper-growth companies introduced the same risk characteristics as late-stage private ventures. As such, segments of public markets are exposed to late-stage VC risk, which rears its head during high participation of retail investors. The combination of higher levels of risk, lower understanding and retail participation draws interesting analogies to tech investing in the late 1990s. This is not to say it’s all gloomy, it’s just different and calls for awareness.

Whatever the conclusion on these drivers, the opportunity set in public markets is set to expand and the tables may have started turning, even if not permanently. With this, we believe, will likely come new opportunities to gain exposure to innovative companies, as well as new risks.

Alantra Global Technology Fund Team

*This article is an extract from the fund’s 2021 outlook letter. If you would like to be added to the fund’s distribution list contact [email protected]

This is article contains information (the “Information”) of Alantra Global Technology Fund (hereinafter, the “Fund”), a subfund of Canepa Funds ICAV, and it has been prepared by Alantra EQMC Asset Management, SGIIC, S.A. (hereinafter, “Alantra AM”). Alantra AM has not obtained an independent verification regarding the accuracy and integrity of the information used, nor a confirmation of the reasonability of the hypothesis considered. The Information has implicit subjective judgements. In particular, most of the criteria are based in estimates of the Fund’s future results. Considering the inherent uncertainties regarding any information concerning the future, some of these hypotheses may not materialize as defined.

The Information is not an offer to buy, sell or subscribe for securities or financial instruments and is not intended to be investment advice. Any decision to buy or sell securities issued by the Fund subject to this Presentation should be based on the legal documentation of the relevant Fund, in particular the subscription agreement and the prospectus of the Fund and the Key Investor Information Document (KIID) as it is filed with the applicable regulatory authorities from time to time, or on publicly available information on the related companies. The recipients of the Information must bear in mind that the securities or instruments discussed in herein may not be suitable for their investment objectives or financial circumstances, and past performance should not be taken as a guarantee of future performance. The Fund is an UCITS fund under the 2009/65/EC Directive.

In light of the above, neither Alantra AM, its officers, directors or employees, or its shareholders, may be held in any way liable for damages that could arise, directly or indirectly, as a result of decisions taken on the basis of this Information or any use given it by its recipients.